As technical analysis is built on the assumption that prices trend, the use of trend lines is important for both trend identification and confirmation. A trend line is a straight line that connects two or more price points and then extends into the future to act as a line of support or resistance. Many of the principles applicable to support and resistance levels can be applied to trend lines as well. It is important that you understand all of the concepts presented in our Support and Resistance article before continuing on.

Definition

Uptrend Line

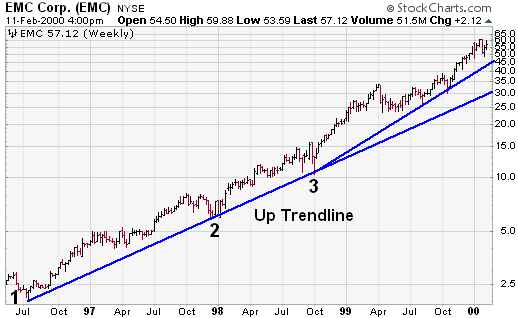

An uptrend line has a positive slope and is formed by connecting two or more low points. The second low must be higher than the first for the line to have a positive slope. Note that at least three points must be connected before the line is considered to be a valid trend line.

Uptrend lines act as support and indicate that net-demand (demand less supply) is increasing even as the price rises. A rising price combined with increasing demand is very bullish, and shows a strong determination on the part of the buyers. As long as prices remain above the trend line, the uptrend is considered solid and intact. A break below the uptrend line indicates that net-demand has weakened and a change in trend could be imminent.

Downtrend Line

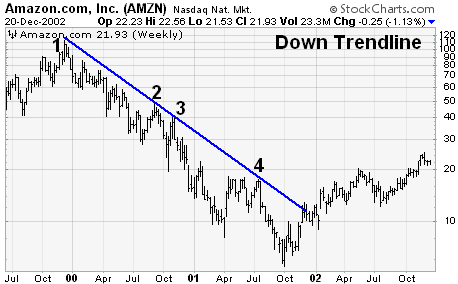

A downtrend line has a negative slope and is formed by connecting two or more high points. The second high must be lower than the first for the line to have a negative slope. Note that at least three points must be connected before the line is considered to be a valid trend line.

Downtrend lines act as resistance, and indicate that net-supply (supply less demand) is increasing even as the price declines. A declining price combined with increasing supply is very bearish, and shows the strong resolve of the sellers. As long as prices remain below the downtrend line, the downtrend is solid and intact. A break above the downtrend line indicates that net-supply is decreasing and that a change of trend could be imminent.

For a detailed explanation of trend changes, which are different than just trend line breaks, please see our article on the Dow Theory.

Scale Settings

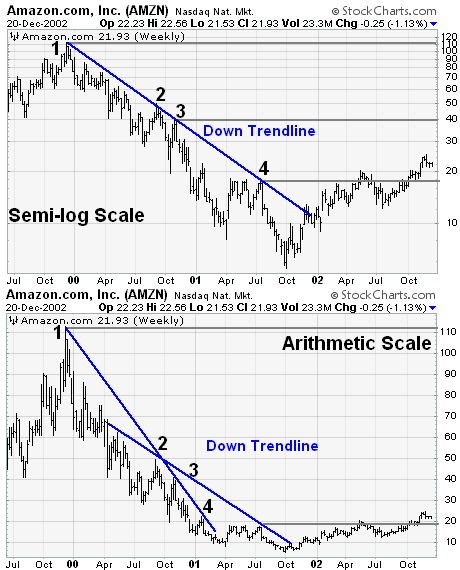

High points and low points appear to line up better for trend lines when prices are displayed using a semi-log scale. This is especially true when long-term trend lines are being drawn or when there is a large change in price. Most charting programs allow users to set the scale as arithmetic or semi-log. An arithmetic scale displays incremental values (5,10,15,20,25,30) evenly as they move up the y-axis. A $10 movement in price will look the same from $10 to $20 or from $100 to $110. A semi-log scale displays incremental values in percentage terms as they move up the y-axis. A move from $10 to $20 is a 100% gain, and would appear to be much larger than a move from $100 to $110, which is only a 10% gain.

In the case of Amazon.com (AMZN), there were two false breaks above the downtrend line as the stock declined during 2000 and 2001. These false breakouts could have led to premature buying as the stock continued to decline after each one. The stock lost 60% of its value three times over a two-year period. The semi-log scale reflects the percentage loss evenly, and the downtrend line was never broken.

In the case of EMC, there was a large price change over a long period of time. While there were not any false breaks below the uptrend line on the arithmetic scale, the rate of ascent appears smoother on the semi-log scale. EMC doubled three times in less than two years. On the semi-log scale, the trend line fits all the way up. On the arithmetic scale, three different trend lines were required to keep pace with the advance.

Validation

It takes two or more points to draw a trend line. The more points used to draw the trend line, the more validity attached to the support or resistance level represented by the trend line. It can sometimes be difficult to find more than 2 points from which to construct a trend line. Even though trend lines are an important aspect of technical analysis, it is not always possible to draw trend lines on every price chart. Sometimes the lows or highs just don't match up, and it is best not to force the issue. The general rule in technical analysis is that it takes two points to draw a trend line and the third point confirms the validity.

The chart of Microsoft (MSFT) shows an uptrend line that has been touched 4 times. After the third touch in Nov-99, the trend line was considered a valid line of support. Now that the stock has bounced off of this level a fourth time, the soundness of the support level is enhanced even more. As long as the stock remains above the trend line (support), the trend will remain in control of the bulls. A break below would signal that net-supply was increasing and that a change in trend could be imminent.

Spacing of Points

The lows used to form an uptrend line and the highs used to form a downtrend line should not be too far apart, or too close together. The most suitable distance apart will depend on the timeframe, the degree of price movement, and personal preferences. If the lows (highs) are too close together, the validity of the reaction low (high) may be in question. If the lows are too far apart, the relationship between the two points could be suspect. An ideal trend line is made up of relatively evenly spaced lows (or highs). The trend line in the above MSFT example represents well-spaced low points.

On the Wal-Mart (WMT) example, the second high point appears to be too close to the first high point for a valid trend line; however, it would be feasible to draw a trend line beginning at point 2 and extending down to the February reaction high.

Angles

As the steepness of a trend line increases, the validity of the support or resistance level decreases. A steep trend line results from a sharp advance (or decline) over a brief period of time. The angle of a trend line created from such sharp moves is unlikely to offer a meaningful support or resistance level. Even if the trend line is formed with three seemingly valid points, attempting to play a trend line break or to use the support and resistance level established it will often prove difficult.

The trend line for Yahoo! (YHOO) was touched four times over a 5-month period. The spacing between the points appears OK, but the steepness of the trend line is unsustainable, and the price is more likely than not to drop below the trend line. However, trying to time this drop or make a play after the trend line is broken is a difficult task. The amount of data displayed and the size of the chart can also affect the angle of a trend line. When assessing the validity and sustainability of a trend line, keep in mind that short and wide charts are less likely to have steep trend lines than long and narrow charts.

Internal Trend Lines

Sometimes there appears to be the possibility of drawing a trend line, but the exact points do not match up cleanly. The highs or lows might be out of whack, the angle might be too steep or the points might be too close together. If one or two points could be ignored, then a fitted trend line could be formed. With the volatility present in the market, prices can over-react, producing spikes that distort the highs and lows. One method for dealing with over-reactions is to draw internal trend lines, which ignore these price spikes to a reasonable degree.

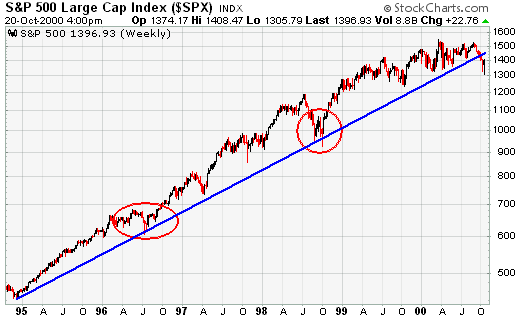

The long-term trend line for the S&P 500 ($SPX) extends up from the end of 1994, and passes through low points in Jul-96, Sept-98 and Oct-98. These lows were formed with selling climaxes, and represented extreme price movements that protrude beneath the trend line. By drawing the trend line through the lows, the line appears to be at a reasonable angle, and the other lows match up extremely well.

Sometimes, there is a price cluster with a high or low spike sticking out. A price cluster is an area where prices are grouped within a tight range over a period of time. The price cluster can be used to draw the trend line, and the spike can be ignored. The Coca Cola (KO) chart shows an internal trend line that is formed by ignoring price spikes and using the price clusters, instead. In October and November 1998, Coke formed a peak, with the November peak just higher than the October peak (red arrow). If the November peak had been used to draw a trend line, then the slope would have been more negative, and there would have appeared to be a breakout in Dec-98 (gray line). However, this would have only been a two-point trend line, because the May-June highs are too close together (black arrows). Once the Dec-99 peak formed (green arrow), it would have been possible to draw an internal trend line based on the price clusters around the Oct/Nov-98 and the Dec-99 peaks (blue line). This trend line is based on three solid touches, and it accurately forecasts resistance in Jan-00 (blue arrow).

Conclusion

Trend lines can offer great insight, but, if used improperly, can also produce false signals. Other items - such as horizontal support and resistance levels or peak-and-trough analysis - should be employed to validate trend line breaks.

While trend lines have become a very popular aspect of technical analysis, they are merely one tool for establishing, analyzing, and confirming a trend. The uptrend line for VeriSign (VRSN) was touched 4 times and seemed to be a valid support level. Even though the trend line was broken in Jan-00, the previous reaction low held and did not confirm the trend line break. In addition, the stock recorded a new higher high prior to the trend line break.

Trend line breaks should not be the final arbiter, but should serve merely as a warning that a change in trend may be imminent. By using trend line breaks for warnings, investors and traders can pay closer attention to other confirming signals for a potential change in trend.

Tidak ada komentar:

Posting Komentar