Gold is known as a safe haven in difficult times. For example, at this time, when the Covid-19 pandemic has made the world economy stumble, many investors have decided to switch to gold.

Investing in physical gold is indeed a way to protect your assets from inflation. However, did you know a simple gold trading strategy for a relatively short period of time?

This strategy also doesn't require you to always be in front of a PC/laptop. So besides being suitable for beginners, this strategy is also suitable for those of you who have a lot of work.

Let's unlock the secret of this easy and simple gold trading !

The secret of the golden movement

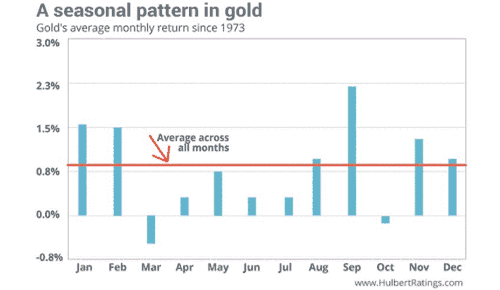

There is a correlation between how gold moves and gold's seasonal pattern. There are certain times of the year when gold is stronger. There are also other times when gold weakens. Although not 100% accurate, the tendency will have the same pattern. Look at the following picture:

The price of gold, according to seasonal cycles, has a tendency to rise in the first quarter and in the last months. September will be one of the best months to buy gold.

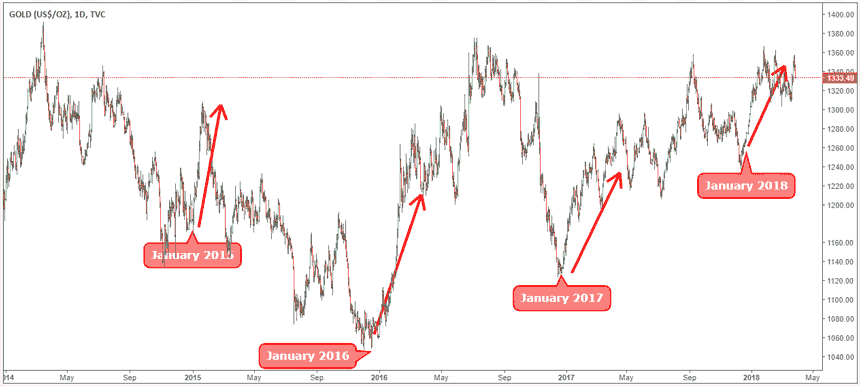

Remember, this is just a general indicator that only gives us an idea of the possible direction of the gold price movement, down or up. The gold chart below is an example of gold price movement.

Short term gold trading strategy

If your goal of trading gold online is for the medium or long term, then you can take advantage of the seasonal patterns shown above.

For short-term or daily strategies, you can use these strategies:

1. Determine the high, low & close price of gold on the previous day

For this first step, in the morning when the market opens you determine the highest/high price, lowest/low price and closing price/close of the previous day's movement.

2. Using pivot points

The second step you just enter the high, low and close prices earlier into the following formula:

Pivot Point (P) = (High + Low + Close) : 3

Note : Currently, many pivot point calculators will automatically calculate the Pivot Point value as well as support and resistance.

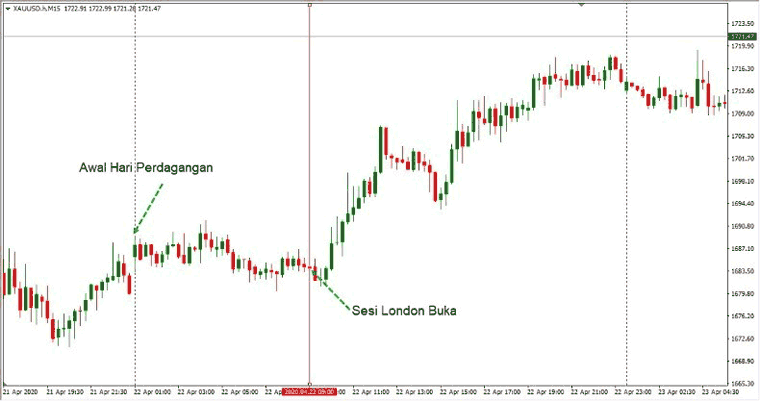

3. Time to start trading gold

The best time to use this strategy is when the London session opens at 14.00 WIB in the summer and at 15.00 WIB in the winter. However, it can be used also at the opening of the New York session with the same success rate.

4. Strategy to open buy and sell positions

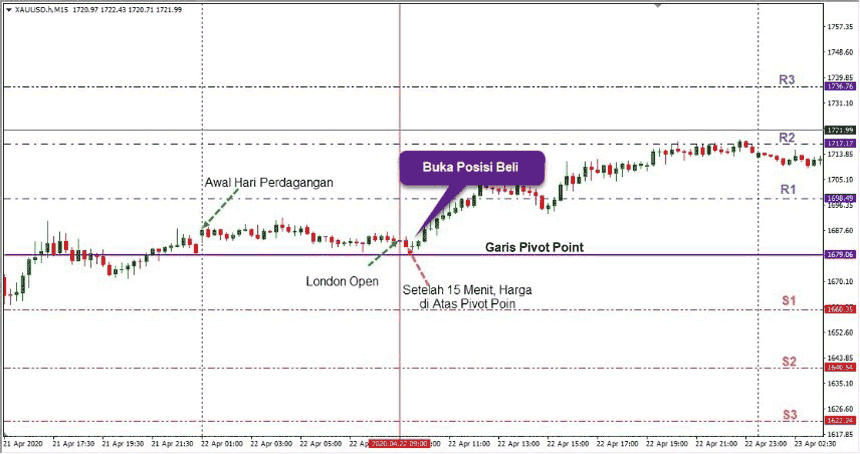

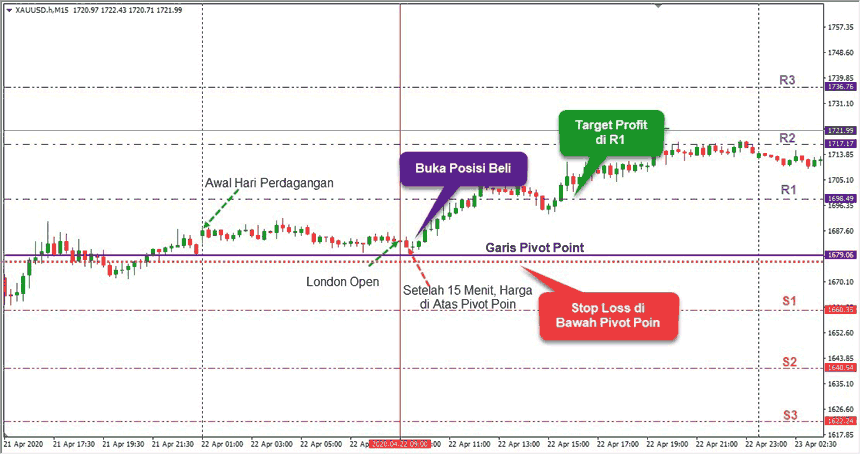

The logic behind this rule is simple, you only need to open a buy position if after the first 15 minutes the price is above the pivot point. On the other hand, open a short position if after the first 15 minutes the price is below the pivot point.

Once the market shows the price is below the pivot point, it is assumed that the downward momentum in the price will continue. If the price is above the pivot point, it is assumed that the upward price momentum will continue.

Important :

If after the first 15 minutes of the London session the price is too close to the first support/resistance level, it is better not to place a position because the profit margin has shrunk.

Don't forget to place a stop loss as a means of protection and place a profit or profit target.

5. Placement of stop-loss

Place a Stop Loss 50-100 pips above the Pivot Point (for Sell positions) and below the Pivot Point (for Buy positions). Take Profit can be placed at Support I (for Sell positions) or at Resistance I (for Buy positions).

If you want to try this simple strategy, please try it on a demo account first . However, for those of you who are risk-takers and want to immediately be able to benefit from trading gold by using these easy and simple trading methods and strategies, you can immediately

Tidak ada komentar:

Posting Komentar